How to calculate Flat Rate and Reducing Interest Rate in UAE?

Banks and financial institutions will offer different types of loans to the customers to fulfil their requirements. But do you any idea about how banks will calculate the interest rate for the different type of loans. Before getting a loan it is important to you to know the interest rate of the loan is calculated.

Many times, the bank employees will not detail you about conditions and other important things in advance, But only showcase the glossy side of the image. Therefore, it is important to get to know about the insights.

In this article. we are talking about how banks and financial institutes calculate the rate of interest for different loans. There are two common methods used for calculating interest on loans namely-flat rates and reducing rates.

reducing interest rate in uae

What is Flat Rate of Interest?

The flat rate of Interest, In simple words, It is the interest rate that is calculated for a whole loan or principal amount throughout its tenure, where it doesn’t take into account that monthly instalments(EMI) reduce the principal amount. This eventually increases the Effective Interest Rate than the nominal Flat Rate initially quoted.

Flat rate of interest method is the same in which you calculate EMI on your simple calculator.

For instance, If you apply for a loan amount of AED 100,000 for 5 years with an interest rate at 5%. This means Every year you need pau an Interest of 5% regardless of how much you reduce the loan.

A total of AED 25000 is paid as a interest to the loan amount(100,000 x 5% = 5,000 and 5,000 x 5 = 25,000).

What Is Reducing Interest Rate?

A reducing interest rate, In simple words, It is the interest rate calculated every month on the outstanding loan balance.

This means, every month you pay and EMI, which includes interest for outstanding loan amount for the month plus principal repayment. On every EMI payment, your outstanding balance decreases by the amount of principal repayment and the next month interest will be calculated on that amount only. hence, the Interest Amount will be reduced.

If we use the same example of applying a loan of AED 100,000 at a 5% reducing balance rate for 5 years tenure.If you pay AED 20,000 each year, the interest for first year would be paying AED 5,000 in interest (100,000 x 5% = 5,000).That means our balance amount is AED 80000(80000*5%)=4000. next year(60000*5%=3,000)and the calculation repeated for next years.

Now you to pay AED 15,000 in interest over the five years.

Reducing rate is always better than the flat rate.

However, you can’t decide your interest rate on your loan, it depends upon the loan you apply. Most probably, For small amounts of loans, the fixed-rate interest is applied like personal loans or car loans. Without any doubt, Reducing rate is best than a flat rate. So Before applying for a loan, It is important to read the small print and not to tempt for the low-interest rate.

Difference between Flat Interest Rate and Reducing Balance Rate

- In flat rate, the interest rate is calculated on the principal amount of the loan. While reducing rate, the interest rate is calculated only on the outstanding loan amount on a monthly basis

- Fixed rates are generally lower than the reducing balance rate. (at the beginning)

- calculating the flat interest rate is easier as compared to reducing balance rate in which the calculations are quite tricky.

- In practical terms, the reducing rate method is better than the flat rate method.

How banks in UAE calculate interest rate on Loans?

All major banks in UAE calculate your loan interest rate on Reducing Rate of Interest Method only. But they might advertise the Flat version of it to make it more attractive for you.

Generally, Personal loan & Car Loan Advertised rates are in Flat rate method., So you need to check your final agreement or loan facility offer letter to know your actual rate of interest.

the simple rule of thumb to convert flat to reducing rate is to multiply the rate with 1.83 for loans up to 48-month tenor.

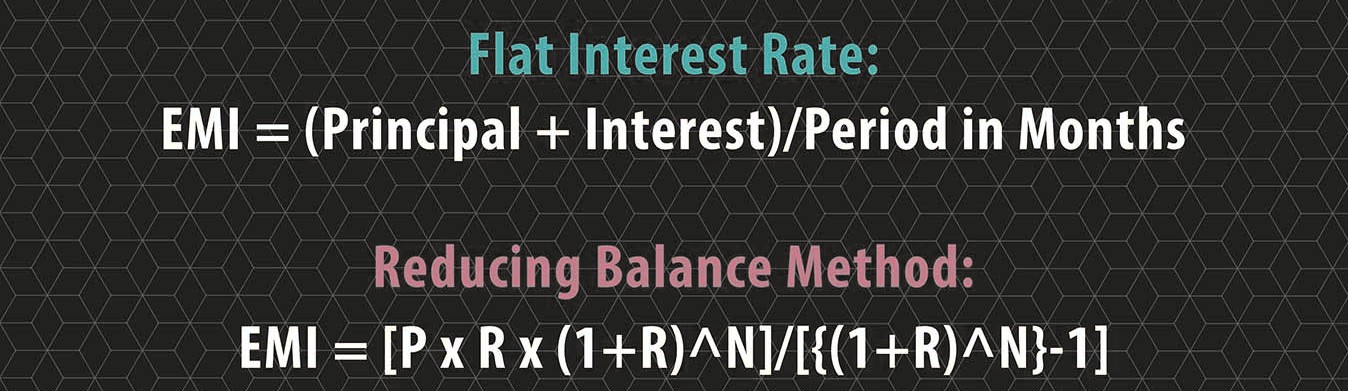

Flat rate and Reducing Interest rate formula

- P = Principal Loan Amount

- R= Rate of Interest per month

- N= Number of Months / Repayment Tenor

flat rate and reducing Interest Rate Formula

Know your Reducing rate of Interest with this reference table

| Repayment Tenor in Years | ||||||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 | 20 | |

| Reducing Rate p.a. |

Flat | Rates | Flat | Rates | ||||

| 5.0% | 2.64% | 2.65% | 2.66% | 2.67% | 2.69% | 2.71% | 2.73% | 2.92% |

| 5.5% | 2.91% | 2.92% | 2.94% | 2.96% | 2.98% | 3.00% | 3.02% | 3.25% |

| 6.0% | 3.18% | 3.20% | 3.22% | 3.24% | 3.27% | 3.30% | 3.32% | 3.60% |

| 6.5% | 3.46% | 3.48% | 3.51% | 3.53% | 3.56% | 3.59% | 3.63% | 3.95% |

| 7.0% | 3.74% | 3.76% | 3.79% | 3.83% | 3.86% | 3.90% | 3.93% | 4.30% |

| 7.5% | 4.01% | 4.05% | 4.08% | 4.12% | 4.16% | 4.20% | 4.24% | 4.67% |

| 8.0% | 4.30% | 4.33% | 4.37% | 4.42% | 4.46% | 4.51% | 4.56% | 5.04% |

| 8.5% | 4.58% | 4.62% | 4.67% | 4.72% | 4.77% | 4.82% | 4.88% | 5.41% |

| 9.0% | 4.86% | 4.91% | 4.96% | 5.02% | 5.08% | 5.14% | 5.20% | 5.80% |

| 9.5% | 5.15% | 5.20% | 5.26% | 5.33% | 5.39% | 5.46% | 5.53% | 6.19% |

| 10.0% | 5.44% | 5.50% | 5.56% | 5.64% | 5.71% | 5.78% | 5.86% | 6.58% |

| 10.5% | 5.72% | 5.79% | 5.87% | 5.95% | 6.03% | 6.11% | 6.19% | 6.98% |

| 11.0% | 6.01% | 6.09% | 6.17% | 6.26% | 6.35% | 6.44% | 6.53% | 7.39% |

| 11.5% | 6.31% | 6.39% | 6.48% | 6.58% | 6.68% | 6.77% | 6.87% | 7.80% |

| 12.0% | 6.60% | 6.69% | 6.79% | 6.90% | 7.00% | 7.11% | 7.22% | 8.21% |

| 12.5% | 6.90% | 7.00% | 7.11% | 7.22% | 7.33% | 7.45% | 7.57% | 8.63% |

| 13.0% | 7.19% | 7.30% | 7.42% | 7.54% | 7.67% | 7.79% | 7.92% | 9.06% |

| 13.5% | 7.49% | 7.61% | 7.74% | 7.87% | 8.01% | 8.14% | 8.27% | 9.49% |

| 14.0% | 7.79% | 7.92% | 8.06% | 8.20% | 8.35% | 8.49% | 8.63% | 9.92% |

| 14.5% | 8.09% | 8.23% | 8.38% | 8.54% | 8.69% | 8.84% | 8.99% | 10.36% |

| 15.0% | 8.40% | 8.55% | 8.71% | 8.87% | 9.03% | 9.20% | 9.36% | 10.80% |

| 15.5% | 8.70% | 8.86% | 9.03% | 9.21% | 9.38% | 9.56% | 9.73% | 11.25% |

| 16.0% | 9.01% | 9.18% | 9.36% | 9.55% | 9.73% | 9.92% | 10.10% | 11.70% |

| 16.5% | 9.32% | 9.50% | 9.70% | 9.89% | 10.09% | 10.28% | 10.48% | 12.15% |

| 17.0% | 9.63% | 9.82% | 10.03% | 10.24% | 10.45% | 10.65% | 10.86% | 12.60% |

| 17.5% | 9.94% | 10.15% | 10.36% | 10.59% | 10.81% | 11.02% | 11.24% | 13.06% |

| 18.0% | 10.25% | 10.47% | 10.70% | 10.94% | 11.17% | 11.40% | 11.62% | 13.52% |

| 18.5% | 10.56% | 10.80% | 11.04% | 11.29% | 11.53% | 11.77% | 12.01% | 13.98% |

| 19.0% | 10.88% | 11.13% | 11.39% | 11.64% | 11.90% | 12.15% | 12.40% | 14.45% |

| 19.5% | 11.20% | 11.46% | 11.73% | 12.00% | 12.27% | 12.54% | 12.79% | 14.92% |

| 20.0% | 11.52% | 11.79% | 12.08% | 12.36% | 12.64% | 12.92% | 13.19% | 15.39% |

| 20.5% | 11.84% | 12.13% | 12.43% | 12.72% | 13.02% | 13.31% | 13.59% | 15.86% |

| 21.0% | 12.16% | 12.46% | 12.78% | 13.09% | 13.40% | 13.70% | 13.99% | 16.33% |

| 21.5% | 12.48% | 12.80% | 13.13% | 13.46% | 13.78% | 14.09% | 14.40% | 16.81% |

| 22.0% | 12.81% | 13.14% | 13.48% | 13.83% | 14.16% | 14.49% | 14.80% | 17.28% |

| 22.5% | 13.13% | 13.48% | 13.84% | 14.20% | 14.55% | 14.89% | 15.21% | 17.76% |

| 23.0% | 13.46% | 13.83% | 14.20% | 14.57% | 14.93% | 15.29% | 15.63% | 18.24% |

| 23.5% | 13.79% | 14.17% | 14.56% | 14.95% | 15.32% | 15.69% | 16.04% | 18.73% |

| 24.0% | 14.12% | 14.52% | 14.93% | 15.33% | 15.72% | 16.09% | 16.46% | 19.21% |

| 24.5% | 14.45% | 14.87% | 15.29% | 15.71% | 16.11% | 16.50% | 16.88% | 19.69% |

| 25.0% | 14.79% | 15.22% | 15.66% | 16.09% | 16.51% | 16.91% | 17.30% | 20.18% |