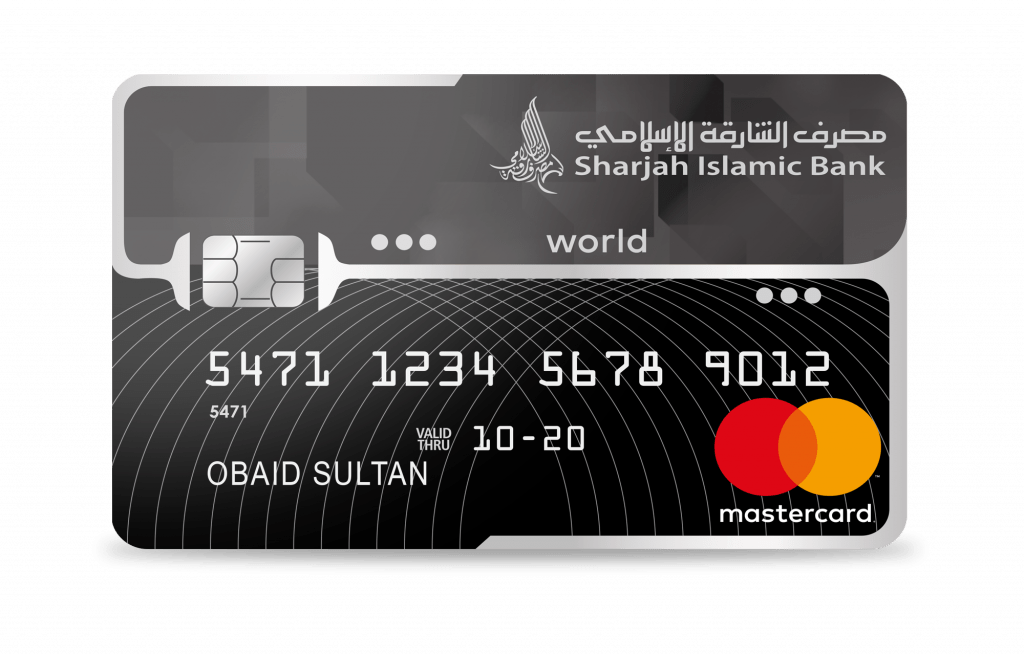

Number 1 credit Card by Sharjah Islamic Bank: Best REWARDS CREDIT CARD of SIB

SIB Smiles Titanium credit card

Benefits

No blackout dates, no cash payment for taxes nor surcharges

SIB Smiles Rewards

Earn 2 Smiles for every AED 2 spent internationally*Earn 1 Smiles for every AED 2 spent locally*

Buy one, get one free offers

Download Mastercard Buy 1 Get 1 app from the App Store

Eligibility for SIB Islamic Credit Card

To apply for SIB Smiles Titanium credit card, A minimum salary of AED 5,000 is required.