Running out of savings but still, have Loan EMIs & Credit Card payments due? Well, in good news, the UAE government and major banks are here with some policies to save you from this ordeal. Ask for your bank for Loan Deferment & Credit Card payment holidays, Here, we listed major banks relief schemes, Find out if you qualify for any of these programs;

Mortgage debt relief for homeowners:

Can’t pay Mortgage EMI? Call your bank and ask for a support/payment deferral facility.

Can’t pay back the cash but have your home on a mortgage? Well, there’s a good chance your bank or mortgage issuer may come up with a debt relief program like payment holidays, payment deferrals in these challenging times.

What is a payment holiday?

it is an agreement between you and your bank where you can stop making loan repayments for a fixed period. These payment holidays are designed to help you when you may experience difficulties in keeping up with your repayment obligations – in this case, due to negative economic fallout arising from the COVID-19 pandemic.

The Central bank of UAE has directed banks and lenders to “treat all their customers fairly” and grant “temporary relief” on retail clients’ loan payments for up to six months from 15 March

For, ADCB Bank Customers loan deferment options

They offered 3 to 6 months deferred Payments options on Personal Loans, Car Loans & Mortgages to people affected because of COVID-19

Personal loans:

Many banks are coming up with policies that might help you cope with your personal loan repayments. These programs will include debt relief, waived fees, and deferred payments. ADCB Bank has announced loan repayment deferral for For all customers, whether an individual or an owner of a business, that are proven to be medically affected by the COVID19 virus outbreak, loan instalments will be deferred and interest will be waived for a period of up to 6 months, subject to the Bank’s review.

The bank has also introduced new measures to help the residents of UAE. With the outbreak of COVID-19, people are losing jobs, and businesses are getting affected. In light of this, ADCB Bank declared that new measures of relief have been in place from April 2. These measures, however, will only be applicable to customers who have passed an ‘appropriate level of scrutiny’

For ADCB customers holding a loan product who are placed on unpaid leave by the employer(s) or their income is affected by the COVID19 virus outbreak, a payment deferral of up to 3 months is offered.

Loan deferment offer by Standard Charted Bank

They also offer relief to Clients impacted by COVID-19, they can apply for a 3 months repayment holiday with 0 fees.

Offer applies to Mortgage, Auto, and Personal Loans.

HSBC Bank UAE Customer can avail loan deferment facility

They offered its Customers who have been placed on unpaid leave by their employers a facility of a one-month repayment holiday without interest and fees for their Personal Loans, Mortgages, and Auto Loans.

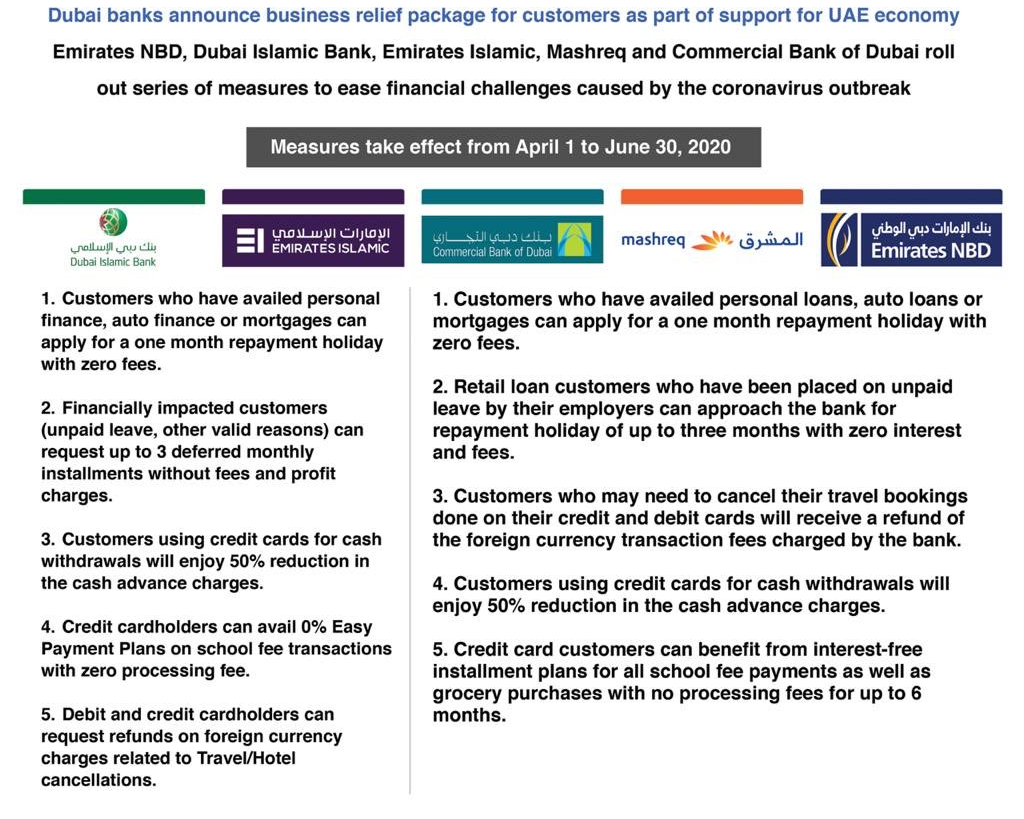

Other major Dubai Banks Including Emirates NBD, Emirates Islamic, Mashreq Bank, Commercial bank of Dubai came together to announced various support measures for the clients helping them during corona times

Not all debtors can secure relief from the banks, It is best to approach your bank to see what debt relief options are available to you and whether your bank can help you with payment holiday or restructuring your debts to make repayments more manageable and regularize your account.

Credit Card Customers are also offered with various benefits like Intrest free instalment plans on big purchases like School fees and rents, Many banks reduced their cash withdrawal fees by 50% to help people with their cash crunch situations.

Do I qualify for a payment holiday?

Every bank in UAE is trying to help their customers during this challenging times. if you are somehow affected by COVID-19 than you should contact your bank or lender, they will review and discuss available options.

Will I have to pay interest?

Yes. You’ll still owe the bank the same amount as you do now, and interest will continue to accrue on this. This means it will take you longer to clear your loan.

Will deferring my payments affect my credit score?

Yes, there might be an effect on your credit score, But if the facility is approved by the bank and you don’t have any past default history, Banks will consider your application positively.

Great, Thanks for this Info.