At present, Your Credit Score has become very important in UAE, Banks decide your eligibility for loans, credit cards, and other products based on your credit score and report. Many unexpected businesses are looking to credit score and deciding what your creditworthiness is, large corporate employers are also started checking your credit history, as per recent news a Real estate companies also checking your credit score before giving an apartment on rent, There are hundreds and many factors that affect the credit score.

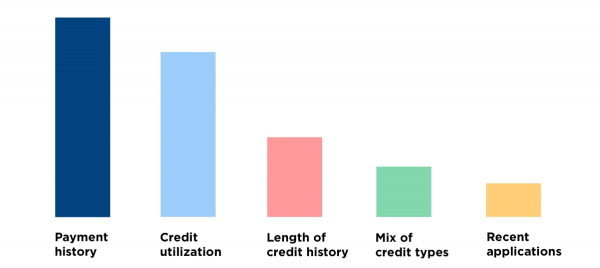

Meanwhile, we take look at the top 5 factors that affect your credit score.

- 1. Payment History

- 2. Credit usage

- 3. Age of credit history

- 4. Types of credit

- 5. Recent credit inquiry /applications

Payment History

Payment history is the most important part of your credit score, Globally it decides the 35% to 40% of your credit score. If you had lent some money from a lender the first question you will hear is “When you will return it”? So the longtime on-time payment will be best for your credit scores. While missing a payment could hurt them.

Serious repayment issues, like write-offs, collections, bankruptcy, repossession or foreclosure can devastate your credit score, which may also make difficult to get approved for a loan or a credit card.

Credit Usage

Credit Usage are around 30% of your credit score. This is one that can be quickly improved or hurt your score. It all depends on the debt you carry measured by the credit utilization ratio.

Credit utilization is the ratio between the total balance you borrow to the total credit limit on all your revolving accounts(credit cards). The lower the utilization ratio the better you can gain the score.

Age of Credit

Globally, the Age of Credit determines 15% to 20% of the credit ratio. The credit score considers how older is your account. The older credit age is better for a credit score.

You might be experiencing the low credit score one closing your old accounts or for opening new accounts. So it is not a bad idea to keep your old account active even if you don’t use it for a while or your score may hurt.

Types of credit

There are two major types of credits -revolving credit card accounts and installment loans. If you are having both these type of accounts it will help you improve your credit score.

This will indicate how you will manage your accounts without any fail in payments. Additionally, If you have loans on different assets like a car, home in addition to this credit card and personal loan account will boost your score. However, if you are having only one account it will not devastate your score.

Credit Inquiries

Each time you submit an application for credit check an inquiry will be placed on your credit report that may cost some points from your credit score or many inquiries will reflect badly on your credit profile If one or two inquiries will not hurt much.

More inquiries in a short span of time will cut off more points from your creditworthiness. Don’t be afraid of getting more cards. Only inquiries made within the last 12 months are important for a bank

Hi

My salary 2500 but I need credit card .